PCP

Representative Example - Personal Contract Purchase: Cash Price £10,000.00, Deposit £1500.00, borrowing £8,500.00 over 4 years at 9.9% Representative APR (fixed). 47 monthly payments of £138.36 followed by a final payment of £4097.02. Total cost of credit of £2238.3 and total amount payable of £12,238.3. Based on 8000 miles per annum, excess mileage charges will apply if this is exceeded. Finance subject to status

What is APR?

An APR, (Annual Percentage Rate), was created to help consumers understand the true cost of borrowing money. It includes the interest rate and any additional charges in your credit offer. In short, a lower APR indicates the cost of borrowing to be less than a higher APR so, if you are comparing two finance deals then the lowest APR is the cheapest - relatively speaking. APR's are different in every case. It can be very confusing and sometimes frustrating, especially if you don't understand why your Annual Percentage Rate is the figure that it is. But it is a requirement for all lenders to let you know the APR before you sign the credit agreement, so you can take time to read through the documents and understand what you are signing up for.

APR and Different products

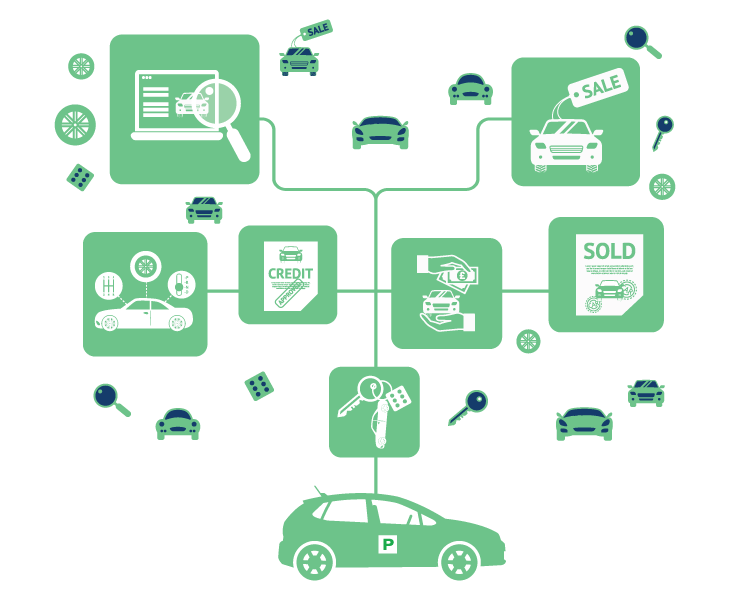

No matter if you are looking to finance a Hire Purchase (HP) deal or a Personal Contract Purchase (PCP) deal, the APR should be clearly shown. However, if you are leasing a car, you won't be given an APR as the agreement is a hire rather than a finance agreement.

Can I get a lower APR somewhere else?

The finance broker will handle your full finance application and will select the best option from a panel of 15 different lenders, However, it is important to note that if for whatever reason, you are unhappy with the APR offered to you, then you can find out more about why that was offered to you by talking to your appointed advisor.

How can I lower my monthly payments?

Make sure your credit score is up to scratch. The broker will cater to all credit scores. However, if you improve your credit score, lenders see that you are more creditworthy and trust your ability to pay it back, so they are more likely to give you a lower rate. Know what you can afford. Work out exactly what is in your budget and find a reasonable price. The more affordable the car, the less you borrow and the less you spend. Make a larger deposit. One of the factors that go into your final figure, alongside your APR, is how much of a deposit you make. If you make a larger deposit, you will owe less over the period of your agreement meaning you could end up paying much less on your monthly repayments.